Custom Taxes To Match How Your Business Runs

Create your custom taxes that may be a part of your business like service charge, fee, conveyance, etc., as every business may have different needs.

Custom taxes to match your business policies

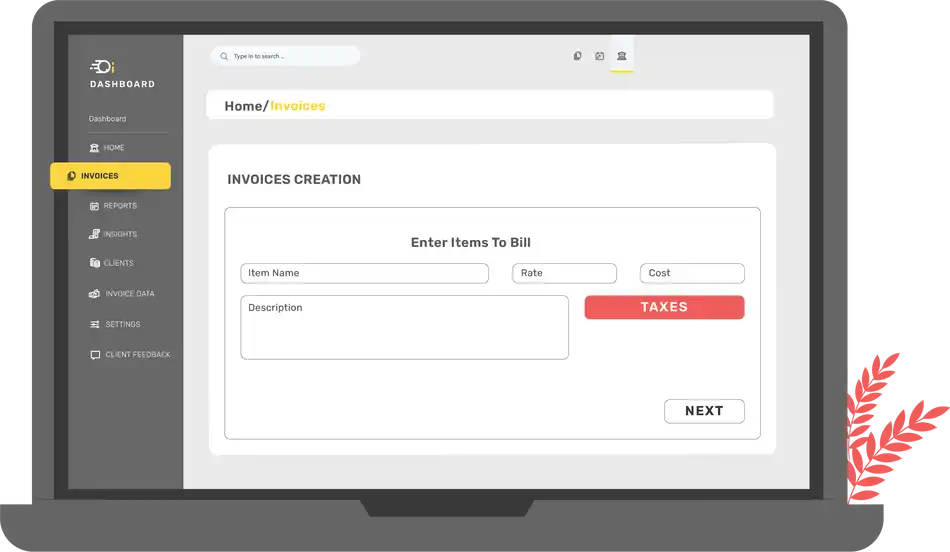

Add Taxes

- Create your own taxes along with government taxes as your business needs.

- Automated tax calculations as you select the applicable taxes.

- Automatically generated sales reports for clear breakdown of your taxes.

Add Taxes

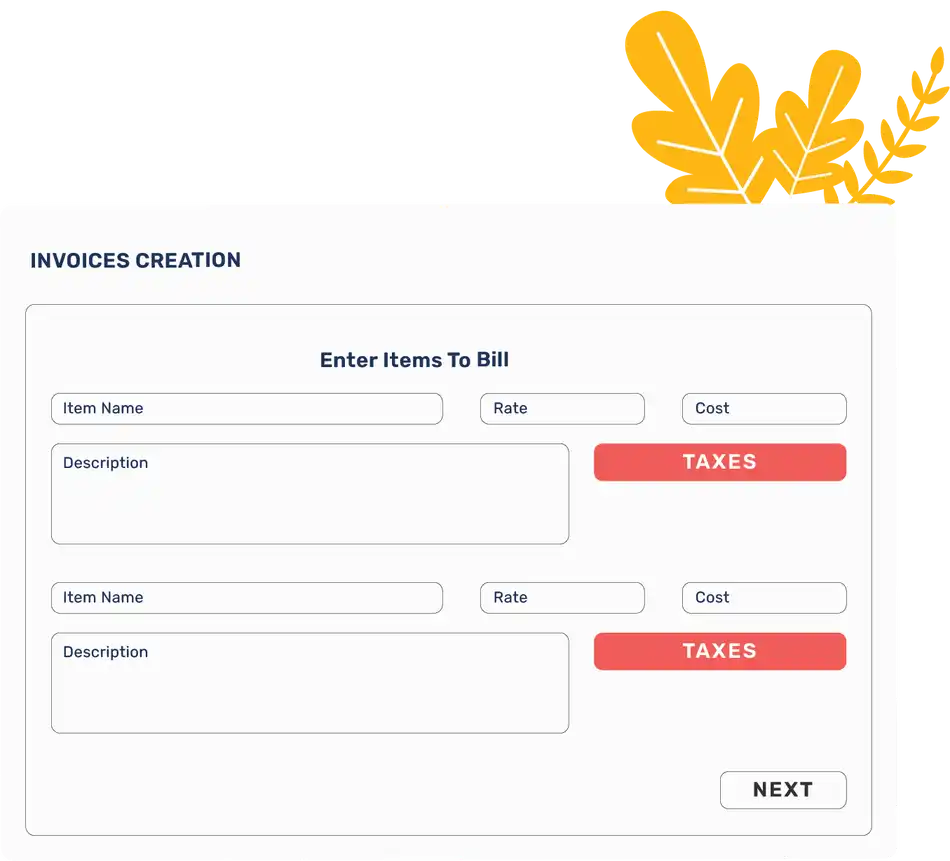

Itemised Taxation

- Capture the correct tax slab for each item or service to which it belongs. Your choice will be remembered for future invoicing.

Itemised Taxation

Intuitive Interface

- Designed with ease of use as first priority providing you with a time saving experience for your peace of mind.

- All processes are designed to be minimal to give you an experience with least amount of data entry and minimum thinking.

- Accessible from all devices with an adaptable interface so you have no bounds of usage and to eliminate dedicated time for accounting to give you an on the go experience.

Intuitive Interface

FAQ's

Yes, you can create GST invoices using Quick Invoice. Quick Invoice also gives you an option to predefine your taxes according to your products or services so that you just have to select the taxes applicable while making the invoice. Also, with our Sales Reports and GST Reports, you can file your taxes easily.

No, there’s absolutely no limits in creating invoices and subscription. We do not restrict our users or charge them extra to make invoices.

There are absolutely no hidden charges whatsoever. You can enjoy full access for just ₹249/month. Our subscriptions are all inclusive and we do not charge our users any additional amounts.